🎯 Sperax는?

Sperax는 블록체인 기술을 활용해 모든 금융인들을 이롭게 하기 위해 시작된 프로젝트입니다.

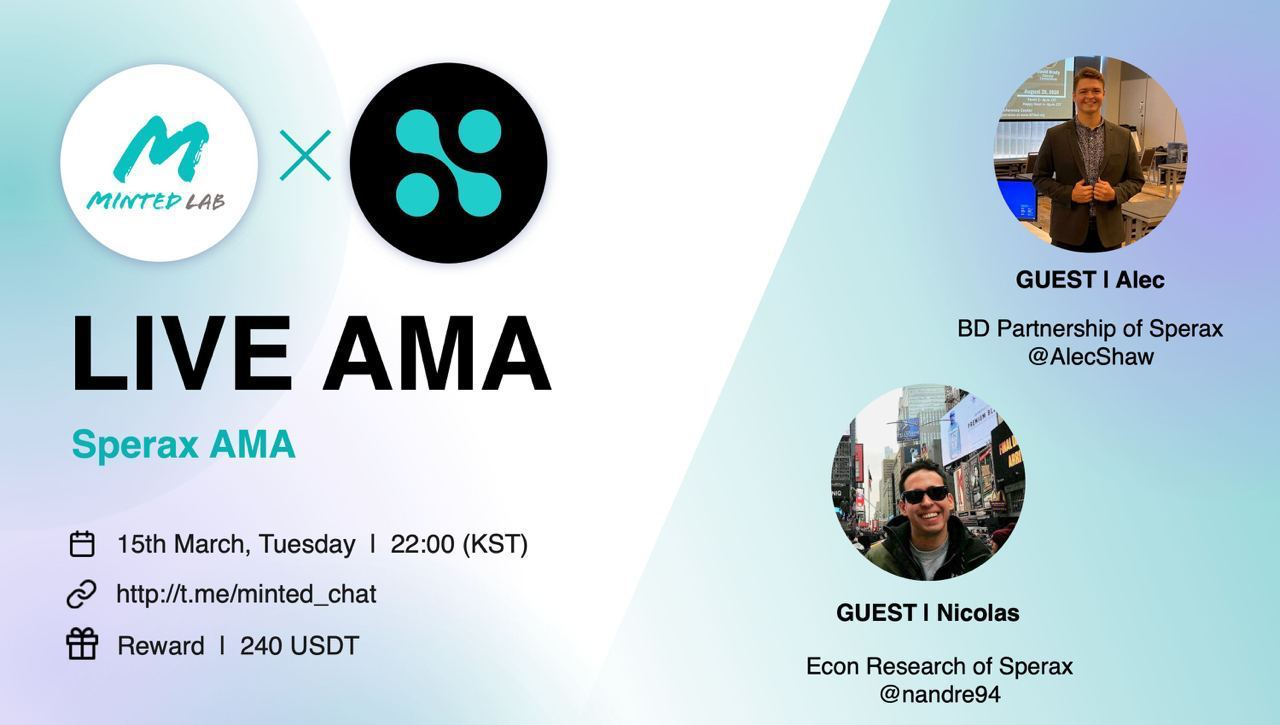

🎯 AMA 내용

Q0-1

안녕하세요 Alec, Nicolas ~! Sperax 프로젝트와 팀에 대해 설명해주세요

Hello Alec, Nicolas, please introduce Sperax project and Team.

A0-1

"Sperax is dedicated to benefiting all financial lives with blockchain technology.

Sperax is the open-source development team focused on building software products on the Sperax protocol. With the Sperax token ($SPA) at its core, Sperax has built the first auto-yield stablecoin, $USDs. Sperax's roadmap is to construct a full-stack DeFi ecosystem based on $USDs featuring various decentralized use cases."

Sperax USD (USDs), which is a world's first hybrid stablecoin with auto-yield. USDs is partially collateralized and partially backed by the protocol's ability to mint SPA when redeeming USDs. This allows for USDs to operate like DAI during market contraction and UST during market expansion.

USDs is goverened and upgraded by SPA token holders, with the SPA token, governance module. Together, these contracts allow the community to propose, vote, and implement changes to the Sperax network.

"Sperax는 블록체인 기술로 모든 금융 생활에 혜택을 주기 위해 최선을 다하고 있습니다.

Sperax는 Sperax 프로토콜을 기반으로 소프트웨어 제품을 구축하는 데 주력하는 오픈 소스 개발 팀입니다. Sperax 토큰($SPA)을 핵심으로 Sperax는 최초의 자동 수익 스테이블 코인인 $USDs를 구축했습니다. Sperax의 로드맵은 다양한 분산 사용 사례를 특징으로 하는 $USDs를 기반으로 하는 풀 스택 DeFi 생태계를 구축하는 것입니다."

Sperax USD(USDs)는 자동 수율이 있는 세계 최초의 하이브리드 스테이블 코인입니다. USD는 USD를 사용할 때 SPA를 발행하는 프로토콜의 기능에 의해 부분적으로 담보되고 부분적으로 뒷받침됩니다. 이를 통해 USD는 시장 축소 중에는 DAI, 시장 확장 중에는 UST처럼 작동할 수 있습니다.

USDs는 SPA 토큰, 거버넌스 모듈과 함께 SPA 토큰 보유자가 관리하고 업그레이드합니다. 이러한 계약을 통해 커뮤니티는 Sperax 네트워크에 대한 변경 사항을 제안, 투표 및 구현할 수 있습니다.

Q0-2

소개 감사합니다

Sperax의 2022년 메인 로드맵은 무엇인가요?

Thanks for the introduction!

What is Sperax's main roadmap for 2022?

A0-2

In the 2022 roadmap, Sperax plans to expand the token ecosystem by introducing the veSPA staking protocol modeled on Curve Finance's veCRV pool. veSPA focuses on long term incentive alignment between $USDs holders and $SPA stakers. veSPA holders become active participants in SperaxDAO governance to continue building out $USDs, while greater $USDs adoption guarantees continued staking incentives for veSPA participants. The veSPA upgrade adds additional utility and value accrual mechanisms to $SPA, complementary to the existing mechanism that burns $SPA as $USDs grows in circulation. These upgrades prove incentive alignment for holders of veSPA and $USDs.

And Data Dashboards, Collateral Diversification, Auto-Yield Stabilizer, Cross-chain interoperability, Cross-chain interoperability and more will be implemented in 2022.

2022년 로드맵에서 Sperax는 Curve Finance의 veCRV 풀을 모델로 한 veSPA 스테이킹 프로토콜을 도입하여 토큰 생태계를 확장할 계획입니다. veSPA는 $USDs 보유자와 $SPA 스테이커 간의 장기적인 인센티브 조정에 중점을 둡니다. veSPA 보유자는 SperaxDAO 거버넌스에 적극적으로 참여하여 계속해서 $USDs를 구축하고, $USDs를 더 많이 채택하면 veSPA 참여자에게 지속적인 스테이킹 인센티브를 보장합니다. veSPA 업그레이드는 $USDs가 유통될 때 $SPA를 소각하는 기존 메커니즘을 보완하는 $SPA에 추가적인 유틸리티 및 가치 발생 메커니즘을 추가합니다. 이러한 업그레이드는 veSPA 및 $USDs 보유자를 위한 인센티브 조정을 증명합니다.

그리고 데이터 대시보드, 담보 다각화, 자동-Yield 안정기, 크로스체인 상호 운용성, 등이 2022년에 구현됩니다.

Q1

How does the veSPA protocol work? Please tell me how to use it easily because the terminology is difficult.

veSPA 프로토콜은 어떻게 작동합니까? 용어가 어렵습니다. 쉽게 사용하는 방법을 알려주세요.

A1

veSPA is going to be the governance model of Sperax. It’s a popular governance model that protocols like Curve, Frax and Anchor have chosen. Effectively the model asks users to temporarily lock their SPA in return of veSPA. The longer someone locks their SPA the more veSPA they will receive. veSPA will be used:

1) to vote or propose governance proposals. People will be able to choose collateral that will be used to back USDs, suggest changes in the investment strategies of the collateral, as well as choose different yield generating strategies.

2) veSPA holders will get all the minting and redeeming fees associated with USDs proportional to their veSPA holding

3) veSPA holders will get 50% of the yield generated from the collateral generated by USDs (the number is subject to change by future governance decisions).

Effectively veSPA will truly decentralise the Sperax model, generate a steady source of passive income and directly like the growth of Sperax stablecoin ecosystem to the value of SPA.

veSPA는 Sperax의 거버넌스 모델이 될 것입니다. Curve, Frax 및 Anchor와 같은 프로토콜이 선택한 인기 있는 거버넌스 모델입니다. 효과적으로 모델은 veSPA의 대가로 사용자에게 SPA를 일시적으로 잠그도록 요청합니다. 누군가가 SPA를 오래 잠그면 더 많은 veSPA를 받게 됩니다. veSPA는 아래와 같이 사용됩니다:

1) 거버넌스 제안에 투표하거나 제안합니다. 사람들은 USDs를 뒷받침하는 데 사용할 담보를 선택하고, 담보의 투자 전략 변경을 제안하고, 다양한 수익 창출 전략을 선택할 수 있습니다.

2) veSPA 보유자는 veSPA 보유량에 비례하여 USDs와 관련된 모든 발행 및 상환 수수료를 받습니다.

3) veSPA 보유자는 USDs로 생성된 담보에서 생성된 수익률의 50%를 받게 됩니다(숫자는 향후 거버넌스 결정에 따라 변경될 수 있음).

veSPA는 효과적으로 Sperax 모델을 진정으로 탈중앙화하고, 수동 소득의 꾸준한 원천을 생성할 것입니다. veSPA는 SPA의 가치에 대한 Sperax 스테이블 코인 생태계의 성장과 직접적으로 유사합니다.

Q2

Please tell me about usds, the stable coin of Sperax. What kind of methods do you use? I'd like to know if it's the same way as usdc or the algorithm method like us.

Sperax의 스테이블 코인 USDs에 대해 알려주세요. 어떤 방법을 사용합니까? usdc와 같은 방식인지, 아니면 우리와 같은 알고리즘 방식인지 알고 싶습니다.

A2

What is USDs?

USDs is a decentralised hybrid yield bearing stablecoin. Hybrid means USDs is collateralized: explicitly by external cryptocurrencies (USDC, ETH and BTC), and implicitly by the USDs protocol, an algorithmic strategy that allows users to burn and mint SPA to support the collateral, and peg, as needed. USDs hybrid model will favor algorithmic stabilisation and scalability during a bull market, while promoting explicit collateralisation and robustness during a bear market.

How does USDs keep its peg?

Arbitrage Price Discovery

If demand for USDs increases over time, the mechanism will lead to SPA deflation. Conversely, the mechanism will defend the peg in situations of low demand at the cost of SPA inflation. This is how it works.

- If USDs trades on exchanges at above $1, arbitrageurs will send SPA and eligible collateral from exchanges, swap it for USDs on Sperax protocol, and sell it, receiving as profit the peg difference.

- If USDs trades below the peg on exchanges, the protocol will still allow people to trade USDs for 1$. In this scenario, arbitrageurs will buy USDs from exchanges at a discount, send it to the protocol, and receive 1$ (denominated in locked collateral and newly minted SPA), and sell it--pocketing the peg difference. The above process will keep happening until arbitrageurs bring the price of USDs back to one dollar.

The above mechanism ensures that any deviation from the peg will be short lived, while ensuring adequate liquidity based on profit maximising incentives. This mechanism is well understood and was first implemented by Terra.

Dynamic transition between algorithmic and collateralized mechanism

One of the key innovations of the Sperax protocol is the possibility to determine the fraction of the money supply that is algorithmically determined versus the fraction that is collateralized. In a nutshell, the algorithm will favor algorithmic stabilisation when USDs trades close to the peg and as USDs matures as an asset. At genesis, Sperax started with 95% collateralization ratio and adjust based on market conditions. During favorable market conditions, we will rely more on algorithmic components; while in unfavorable market conditions, we will rely more on other cryptocurrencies. This mechanism makes USDs more closely resembling stablecoins like DAI during bear markets while keeping the scalability and token burning benefits of stablecoins like Terra during bull markets

Yield Bearing Stablecoin

USDs is the first decentralised stablecoin that will generate passive income for its users just by holding it. USDs holders receive passive income by leveraging DeFi primitives. In the current implementation APY is generated by automatically reinvesting USDs collateral on Curve. In the future we plan to integrate more DeFi protocols such as Aave, Anchor, Compound, Yearn Finance etc. USDs holders will be receiving a diversified source of yield from multiple chains and multiple platforms, just by holding their coins.

USDs 란 무엇입니까?

USDs는 스테이블코인을 보유한 분산형 하이브리드 수익률입니다. 하이브리드는 USDs가 담보화되었음을 의미합니다. 명시적으로 외부 암호화폐(USDC, ETH 및 BTC)에 의해, 그리고 암시적으로 USDs 프로토콜에 의해 사용자가 SPA를 소각하고 발행하여 담보를 지원하고 필요에 따라 고정할 수 있는 알고리즘 전략입니다. USDs의 하이브리드 모델은 강세장에서 알고리즘 안정화와 확장성을 선호하는 반면 약세장에서는 명시적 담보와 견고성을 촉진합니다.

USDs는 페그를 어떻게 유지합니까?

차익 거래 가격 발견

USD에 대한 수요가 시간이 지남에 따라 증가하면 메커니즘이 SPA 디플레이션으로 이어질 것입니다. 반대로 이 메커니즘은 수요가 낮은 상황에서 SPA 인플레이션을 희생시키면서 페그를 방어할 것입니다. 이것이 작동하는 방식입니다.

- USDs가 $1 이상의 거래소에서 거래되는 경우 차익 거래자는 SPA 및 적격 담보를 거래소에서 보내고 Sperax 프로토콜에서 USDs로 교환한 후 매도하여 페그 차액을 이익으로 받습니다.

- USDs가 거래소에서 페그 미만으로 거래되는 경우 프로토콜은 여전히 사람들이 USDs를 1$에 거래할 수 있도록 허용합니다. 이 시나리오에서 차익 거래자는 거래소에서 USDs를 할인된 가격으로 구매하여 프로토콜로 보내고 1$(잠긴 담보 및 새로 발행된 SPA로 표시)를 받고 페그 차액을 넣어 판매합니다. 위의 과정은 차익거래자가 USDs의 가격을 1달러로 되돌릴 때까지 계속될 것입니다.

위의 메커니즘은 페그에서 벗어난 모든 것이 단기적으로 유지되는 동시에 이익을 극대화하는 인센티브를 기반으로 적절한 유동성을 보장합니다. 이 메커니즘은 잘 알려져 있으며 Terra에 의해 처음 구현되었습니다.

알고리즘 및 담보 메커니즘 간의 동적 전환

Sperax 프로토콜의 주요 혁신 중 하나는 알고리즘으로 결정된 통화 공급의 비율과 담보된 비율을 결정할 수 있는 가능성입니다. 간단히 말해서, 이 알고리즘은 USDs가 페그에 가깝게 거래되고 USDs가 자산으로 성숙함에 따라 알고리즘 안정화를 선호합니다. 제네시스에서 Sperax는 95%의 담보율로 시작하여 시장 상황에 따라 조정했습니다. 유리한 시장 상황에서 우리는 알고리즘 구성 요소에 더 많이 의존할 것입니다. 불리한 시장 상황에서 우리는 다른 암호화폐에 더 많이 의존할 것입니다. 이 메커니즘은 USDs가 약세장 동안 DAI와 같은 스테이블 코인을 더 가깝게 닮게 만드는 동시에 강세장 동안 Terra와 같은 스테이블 코인의 확장성과 토큰 소각 이점을 유지합니다.

수익률 베어링 Stablecoin

USDs는 보유하는 것만으로도 사용자에게 수동 소득을 생성하는 최초의 탈중앙화 스테이블 코인입니다. USDs 소지자는 DeFi 프리미티브를 활용하여 수동 소득을 얻습니다. 현재 구현에서 APY는 Curve에 USDs 담보를 자동으로 재투자하여 생성됩니다. 앞으로 우리는 Aave, Anchor, Compound, Yearn Finance 등과 같은 더 많은 DeFi 프로토콜을 통합할 계획입니다. USDs 보유자는 코인을 보유하는 것만으로도 여러 체인 및 여러 플랫폼에서 다양한 수익원을 받게 될 것입니다.

Q3

I am curious to know what inspired you to design Sperax

Sperax를 디자인하게 된 동기가 무엇인지 궁금합니다.

A3

I was one of the early team members and huge supporters of Terra (even lived in Seoul for a year back in the early days of Terra). I was fascinated by the elegant design of Terra and wanted to preserve the scalability and economic benefits it offers. At the same time though algo stablecoins tend to suffer from reflexivity. In a pure algorithmic system the stablecoin is backed only by the governance token. However the governance token is valuable only to the extent the system continues to operate and captures future profits. If heavy redemptions affect the belief that investors have of the system, the stablecoin will suffer, which will cause even more redemptions creating a death spiral. The example of Iron/Titan was an example of that as well as the total failure of Basis Cash. This risk of purely endogenous collateral is something that even Terra has recognised, hence introducing a reserve fund. Sperax design introduces that hybrid model explicitly in its design to minimise the a belief driven crisis, while also utilising that excess capital to generate yield for holders of the stablecoin

저는 Terra의 초기 팀원이자 열렬한 지지자 중 한 명이었습니다(Terra 초창기에는 서울에서 1년 동안 살았습니다). 저는 Terra의 디자인에 매료되어 Terra가 제공하는 확장성과 경제적 이점을 유지하고 싶었습니다. 동시에 알고리즘 스테이블 코인은 반사성으로 고통받는 경향이 있습니다. 순수한 알고리즘 시스템에서 스테이블코인은 거버넌스 토큰에 의해서만 뒷받침됩니다. 그러나 거버넌스 토큰은 시스템이 계속 작동하고 미래 이익을 포착하는 범위에서만 가치가 있습니다. 무거운 상환이 투자자의 시스템에 대한 믿음에 영향을 미치는 경우 스테이블 코인은 피해를 입고 더 많은 상환으로 인해 죽음의 소용돌이가 발생합니다. Iron/Titan의 예는 Basis Cash의 완전한 실패뿐 아니라 그 예였습니다. 순전히 내생적 담보의 이러한 위험은 Terra조차도 인식한 것이므로 예비 기금을 도입합니다. Sperax 디자인은 믿음 중심의 위기를 최소화하는 동시에 그 초과 자본을 활용하여 스테이블 코인 보유자를 위한 수익률을 생성하기 위해 디자인에 하이브리드 모델을 명시적으로 도입합니다.

Q4

Why does Sperax choose to build on Arbitrum instead of others such as Polygon, Solana, BSC?

Sperax가 Polygon, Solana, BSC와 같은 다른 기업 대신 Arbitrum을 기반으로 구축하기로 선택하는 이유는 무엇입니까?

A4

We chose Arbitrum for two reasons: security and transaction throughput. This is the first of many popular blockchains in which $USDs will be live. First let me explain why we chose Arbitrum then expalin the cross chain plan.

Arbitrum uses a technology called optimistic rollups. This technology borrows the security benefits of Ethereum, meaning that it doens't use any centralized bridges and that user funds are always availalble on Ethereum, even if Arbitrum goes offline. This makes it the safest possible scaling solution. No need for bridges.

Arbitrum also features extremely cheap transaction fees even though it has the same security guarantees as Ethereum L1. These cheaper fees are good for SperaxUSD users in 2 ways. First it creates an extremely tight peg so USDs is always worth $1. Users don't have to worry about USDs losing the peg. Also, the cheaper transaction fees allows for the users to send and recieve paymetns in USDs just like their favorate payment and banking app. No need to pay high gas fees.

Secondly, SperaxUSD will begin it's cross-chain deployment in Q2 of 2022. This means that Sperax and the auto-yield sdtablecoin $USDs will be live on all major blockchians including NEAR (Aurora), Avalanche, Polygon, Fantom and more! Each chain will have a native deployment of $USDs offering passive stablecoin yield products for the members of each respective community! The native interation will feature yield generating strategies most applicable to the respective ecosystem.

우리는 보안과 트랜잭션 처리량이라는 두 가지 이유로 Arbitrum을 선택했습니다. 이것은 $USDs가 활성화될 많은 인기 있는 블록체인 중 첫 번째입니다. 먼저 Arbitrum을 선택한 이유를 설명하고 크로스 체인 계획을 설명하겠습니다.

Arbitrum은 옵티미스틱 롤업이라는 기술을 사용합니다. 이 기술은 이더리움의 보안 이점을 차용합니다. 즉, 중앙 집중식 브릿지를 사용하지 않으며 Arbitrum이 오프라인 상태인 경우에도 사용자 자금을 이더리움에서 항상 사용할 수 있습니다. 따라서 가장 안전한 확장 솔루션입니다. 브릿지가 필요하지 않습니다.

Arbitrum은 또한 Ethereum L1과 동일한 보안 보장을 가지고 있음에도 불구하고 매우 저렴한 거래 수수료를 제공합니다. 이러한 저렴한 수수료는 두 가지 측면에서 SperaxUSD 사용자에게 좋습니다. 먼저 USDs는 항상 $1의 가치가 있도록 매우 단단한 고정을 만듭니다. 사용자는 페그를 잃어버리는 USDs에 대해 걱정할 필요가 없습니다. 또한 거래 수수료가 저렴하여 사용자가 즐겨 사용하는 결제 및 뱅킹 앱과 마찬가지로 USDs로 결제를 보내고 받을 수 있습니다. 높은 가스 요금을 지불할 필요가 없습니다.

둘째, SperaxUSD는 2022년 2분기에 교차 체인 배포를 시작할 것입니다. 이는 Sperax와 자동 수익률 sdtablecoin $USDs가 NEAR(Aurora), Avalanche, Polygon, Fantom 등을 포함한 모든 주요 블록체인에서 활성화된다는 것을 의미합니다! 각 체인에는 각 커뮤니티의 구성원을 위해 수동적 스테이블코인 수익률 제품을 제공하는 $USD의 기본 배포가 있습니다! 기본 상호 작용은 각 생태계에 가장 적합한 수율 생성 전략을 특징으로 합니다.

Q5

I would like to know about the uses of the $SPA token What role does a token play in Sperax? What are the advantages for holders?

$SPA 토큰의 용도에 대해 알고 싶습니다. Sperax에서 토큰은 어떤 역할을 하나요? 보유자에게는 어떤 이점이 있습니까?

A5

The SperaxUSD protocol has an elegant two token system. This system features who tokens.

1) Yield bearing stablecoin: $USDs - pegged to $1 and new $USDs is added directly to the user wallet.

2) Governance and economic buffer token: $SPA - fluctuates in market price and is used to govern the protocol and keep $USDs $1 peg.

$SPA plays a very important role in keeping $USDs pegged to $1 and the SepraxUSD open, decentralized and censorship resitsant. $SPA has a very elegant feature where as $USDs grows, a small amount of $SPA is required to be burned. This means as $USDs grows, the protocol will control more value in the reserves, but there will LESS units of $SPA in the market due to the burn. Thanks to the economic buffering power of $SPA, the protocol will adjust how much collateral is needed vs $SPA to ensure $USDs is stable and generates high yield for holders.

$SPA is also used to govern the protocol. This is very important becuase SperaxUSD operates completely on-chain and will soon be managed competely by DAO and on-chain token votes. This means that no central party is able to upgrade or change the rules of the protocl without public vote.

SperaxUSD 프로토콜에는 2개의 토큰 시스템이 있습니다. 이 시스템은 누가 토큰을 제공하는지를 특징으로 합니다.

1) 수익률 베어링 스테이블 코인: $USDs - $1에 고정되고 새로운 $USDs가 사용자 지갑에 직접 추가됩니다.

2) 거버넌스 및 경제 버퍼 토큰: $SPA - 시장 가격이 변동하며 프로토콜을 관리하고 $USDs를 $1 페그로 유지하는 데 사용됩니다.

$SPA는 $USDs를 $1에 고정하고 SepraxUSD를 개방, 분산 및 검열에 저항하도록 유지하는 데 매우 중요한 역할을 합니다. $SPA에는 $USDs가 증가함에 따라 소량의 $SPA가 소각되어야 하는 기능이 있습니다. 즉, $USDs가 증가함에 따라 프로토콜은 준비금에서 더 많은 가치를 제어하지만 소각으로 인해 시장에 $SPA 단위가 더 적습니다. $SPA의 경제적 완충력 덕분에 프로토콜은 $USDs가 안정적이고 보유자에게 높은 수익률을 생성할 수 있도록 $SPA에 비해 필요한 담보의 양을 조정합니다.

$SPA는 프로토콜을 관리하는 데도 사용됩니다. 이것은 SperaxUSD가 완전히 온체인으로 운영되고 곧 DAO 및 온체인 토큰 투표에 의해 경쟁적으로 관리될 것이기 때문에 매우 중요합니다. 이것은 중앙 집단이 공개 투표 없이 프로토콜의 규칙을 업그레이드하거나 변경할 수 없음을 의미합니다.

* 해당 포스팅은 투자 관련 정보 공유의 목적으로 포스팅된 글이며 투자 권유가 아닙니다. 그러므로 개인 투자의 책임은 모두 본인에게 있으니 참고하셔서 투자하시기 바랍니다.

잘못된 정보 혹은 재미있게 보셨다면 댓글 부탁드립니다.

보다 빠른 정보는 텔레그램 채널과 채팅방, 카카오톡 채팅방을 통해 받아보세요 :)

텔레그램 공지방 : https://t.me/minted_labs

텔레그램 채팅방 : https://t.me/minted_chat

카카오톡 오픈 채팅방 : https://open.kakao.com/o/gFVbSeSd (입장코드 : m3309)

'Project AMA Recap (요약)' 카테고리의 다른 글

| [Nyan Heroes] Nyan Heroes AMA 정리 (0) | 2022.05.09 |

|---|---|

| [NFTSTAR] NFTSTAR AMA 정리 (0) | 2022.03.24 |

| [YOUR] YOUR AMA 정리 (0) | 2022.03.15 |

| [SIDUS] SIDUS HEROES AMA 정리 (0) | 2022.03.10 |

| [TAUM] Oribitau AMA 정리 (0) | 2022.02.22 |